Easy Loans Ontario: Simplified Approaches to Financial Backing

Easy Loans Ontario: Simplified Approaches to Financial Backing

Blog Article

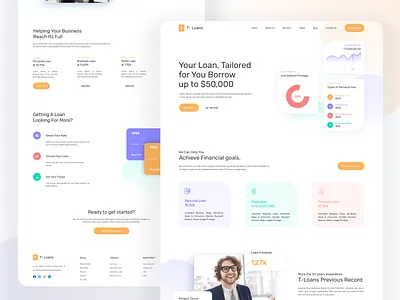

Empower Your Desires With Hassle-free Funding Solutions That Help You

In a fast-paced world where goals usually need sponsorship, finding the best assistance system can be essential subsequently your desires right into truth. Convenient loan services offer a lifeline for those looking for to seek their objectives right away, providing a series of choices customized to individual needs and scenarios. From flexible repayment strategies to streamlined application processes, these services goal to link the space in between aspiration and achievement. However just what do these lendings entail, and just how can they be the secret to unlocking your potential? Let's explore the different facets of convenient loan services and how they can equip you to reach new heights.

Kinds Of Convenient Loans

What are the various kinds of convenient loans readily available to fit various economic demands and goals? When discovering convenient finance alternatives, people can pick from a selection of financing types tailored to their specific demands. Personal finances are a preferred option for borrowers seeking adaptability in operation the funds for different functions, such as financial obligation consolidation, home improvements, or unexpected costs. These loans commonly have actually repaired interest rates and foreseeable month-to-month payments, making budgeting simpler.

For those looking to fund a particular purchase, such as a cars and truck or home, vehicle loans and mortgages offer tailored funding solutions with affordable passion prices based upon the property being funded. Additionally, borrowers can opt for pupil fundings to cover educational expenditures, with versatile settlement terms and favorable passion prices.

In addition, people with a strong credit rating background might certify for low-interest price finances, while those with less-than-perfect credit report can explore choices like payday advance loan or safeguarded lendings that require collateral. By comprehending the various types of practical finances offered, consumers can make enlightened choices that line up with their monetary goals.

Qualification Requirements

When considering eligibility for numerous funding alternatives, lending institutions typically evaluate a variety of elements to figure out a candidate's viability for loaning. The main eligibility demands for most car loans include the applicant's credit history, earnings level, employment standing, and debt-to-income ratio. An excellent credit rating is usually vital in securing beneficial lending terms, as it demonstrates a background of liable financial behavior. Lenders likewise examine the candidate's income to guarantee they have the means to settle the funding. Secure work additionally ensures lending institutions of a constant income stream to fulfill repayment obligations. Furthermore, loan providers think about the applicant's debt-to-income ratio, which contrasts the quantity of financial obligation an individual brings to their general income. A reduced ratio shows a healthier economic placement and a higher likelihood of loan approval. Satisfying these eligibility requirements is important for accessing practical car loan services that line up with your economic demands and objectives. By recognizing and fulfilling these criteria, you can enhance your chances of safeguarding the lending you prefer.

Application Refine

Upon completing the qualification assessment and meeting the essential requirements, candidates can continue with the streamlined application procedure for accessing convenient car loan services customized to their this post financial purposes. The application process is designed to be easy and efficient, allowing individuals to apply for the desired finance effortlessly. To initiate the application, candidates are usually called for to provide standard individual info, such as their name, get in touch with details, and proof of recognition. In addition, financial info like income sources, work details, and existing debts may be asked for to analyze the candidate's financial capability and credit reliability.

Once the first details is sent, applicants may need to specify the funding quantity, payment terms, and objective of the funding. After the submission, the loan provider will examine the application and carry out an extensive analysis to establish the applicant's qualification and the loan terms that straighten with their monetary goals.

Lending Payment Options

Advantages of Convenient Loans

One of the crucial benefits of convenient lendings hinges on their capability to simplify the loaning procedure for individuals seeking to accomplish their economic objectives efficiently. These click here to read fundings use a fast and hassle-free application procedure, frequently allowing consumers to apply online without the demand for considerable documentation or numerous in-person brows through to a bank. This streamlined method saves useful time and initiative for consumers that call for funds immediately.

Moreover, convenient loans normally have versatile eligibility requirements, making them obtainable to a wider series of individuals, including those with varying credit history ratings. This inclusivity makes sure that even more individuals can gain from these economic products when they require them most.

Convenient fundings additionally frequently included affordable rate of interest prices and favorable terms, allowing customers to handle their settlements effectively. my company In addition, some loan providers provide customized financing choices customized to the particular needs and scenarios of the consumer, additional boosting the overall convenience and viability of the financing. Overall, the advantages of hassle-free car loans empower people to satisfy their monetary goals easily and effectiveness.

Verdict

In final thought, hassle-free fundings provide a range of choices to empower people to accomplish their desires. loan ontario. Overall, practical loans provide advantages that can aid people navigate their financial goals with self-confidence and comfort.

When checking out practical loan options, individuals can choose from a range of funding types customized to their particular needs.Once the first info is sent, candidates might need to define the financing quantity, payment terms, and function of the financing.After efficiently protecting the desired loan and embarking on the journey towards recognizing their financial aspirations, consumers are offered with an array of structured financing payment options to properly handle their economic obligations. Additionally, some loan providers supply individualized financing options customized to the details needs and situations of the borrower, further enhancing the general comfort and suitability of the funding. Generally, convenient financings offer benefits that can help people navigate their economic goals with self-confidence and ease.

Report this page